The goal of any business is to make a profit. Whether you are earning $1,000 a month in sales, or $100,000 a month in sales – there is only one vital statistic for business health – how much do you keep as profit?

How To Get Profitable

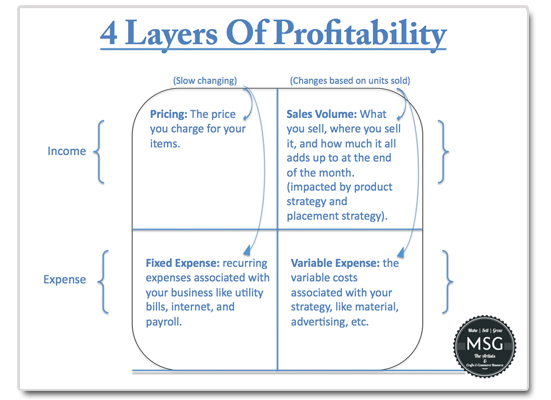

This chart is loosely based on the work of Jagmohan Raju – he calls it 4 “levers” of profitability. I’ve oriented the 4 ‘levers’ to include an income and expense view of things:

Let’s quickly review the 4 layers of profitability outlined in the chart. On the income side of the ledger you have:

Pricing: how much you charge for your items. Of course this can include fixed prices, variable prices and even auction pricing.

Sales Volume: This includes the total of all units sold. Some small businesses have 1 product and sell a lot of it, some have many products and sell a few of them.

On the expense side of the ledger you have:

Fixed Expenses: These expense items are fairly stable and include things like rent, salaries, property tax, insurance, and utilities.

Variable Expenses: These expense items change based on sales volume and other very flexible business decisions and include things like advertising cost, material cost, credit card processing fees, and shipping costs.

At the end of the month (or day or year, etc.) the math is very simple:

Total income from sales minus expenses equals profit. At the end of the day it is up to the entrepreneur to creatively increase income while holding expenses flat or lowering them.

Widening The Jaws

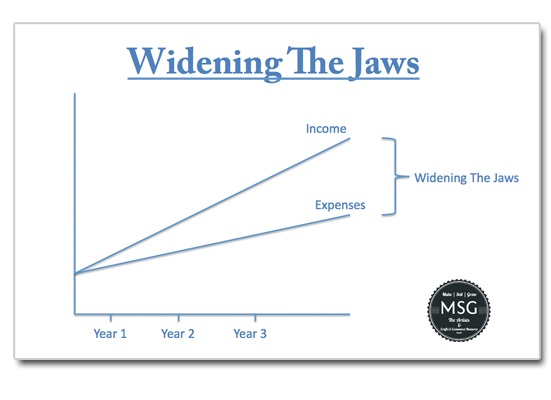

I once had an old boss who always talked about “widening the jaws” and would always draw a simple little chart when doing budget reviews with his managers. He would use that phrase to always remind his managers that we COULD grow expenses, but they had to grow at a slower pace than income in order for our total profit to continue to improve. Here is what that looked like:

Some business make plenty of sales, but they suffer from poor profit because they have out of control expenses. In those cases – you can improve profit substantially by cutting expenses.

Other businesses have poor sales – and the best way to improve is to increase the income side of the equation. That might take a new product, a new pricing strategy, or a revamp of the existing product strategy.

But most businesses reside somewhere in the middle – okay sales – and average expenses. In those cases success is made in the margin. In finding the little, incremental improvement in sales or expense optimization, and continously making those wise choses.

I hope 2016 is a very profitable year for you!

Ps. Am I right in my analysis? Are there more than 4 layers of profitability? I’d love to know what you think!